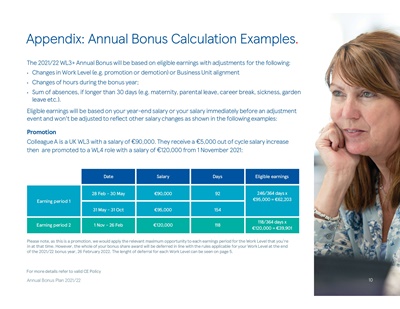

Date Salary Days Eligible earnings

Earning period 1

28 Feb - 30 May €90,000 92 246/364 days x

€95,000 = €62,203

31 May - 31 Oct €95,000 154

Earning period 2 1 Nov - 26 Feb €120,000 118

118/364 days x

€120,000 = €39,901

Appendix: Annual Bonus Calculation Examples.

The 2021/22 WL3+ Annual Bonus will be based on eligible earnings with adjustments for the following:

• Changes in Work Level (e.g. promotion or demotion) or BusinessUnit alignment

• Changes of hours during the bonus year;

• Sum of absences, if longer than 30 days (e.g. maternity, parental leave, career break, sickness, garden

leave etc.).

Eligible earnings will be based on your year-end salary or your salary immediately before an adjustment

event and won't be adjusted to reflect other salary changes as shown in the following examples:

Promotion

ColleagueA is a UK WL3 with a salary of €90,000. They receive a €5,000 out of cycle salary increase

then are promoted to a WL4 role with a salary of €120,000 from 1 November 2021:

10

Annual Bonus Plan 2021/22

For more details refer to valid CE Policy

Please note, as this is a promotion, we would apply the relevant maximum opportunity to each earnings period for the Work Level that you're

in at that time. However, the whole of your bonus share award will be deferred in line with the rules applicable for your Work Level at the end

of the 2021/22 bonus year, 26 February 2022. The lenght of deferral for each Work Level can be seen on page 5.